Business

Ameresco Announces Several Battery Energy Storage System (BESS) Projects

July 13th, 2023

![[photo] Ameresco Battery Energy Storage Systems (BESS)](https://www.framingham.com/news/wp-content/uploads/2023/07/ameresco-battery-storage-150x79.jpg)

FRAMINGHAM, MA — Cleantech integrator Ameresco, Inc., (NYSE: AMRC), has been winning contracts and partnerships to build and operate some of the largest Battery Energy Storage Systems (BESS) in North America. Over the past month or so, Ameresco, headquartered in Framingham, Massachusetts (USA) has announced BESS related projects in California and Colorado in the US and in… [read more].

Framingham Retail Marijuana Price War Claims First Victim

June 5th, 2023

FRAMINGHAM, MA – Trulieve, one of the five Framingham cannabis dispensaries located on Worcester Road, (Route 9), has announced it will be closing up shop on June 30th, 2023. In a June 1, 2023 press release to investors Trulieve Cannabis Corp. (CSE:TRUL / OTCQX:TCNNF) a Florida based publicly traded cannabis company announced “additional measures to preserve cash… [read more].

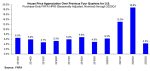

Framingham Area Home Prices Rise Faster Than National Average

June 3rd, 2023

FRAMINGHAM, MA – According to a Federal Housing Finance Agency House Price Index (FHFA HPI®) report U.S. house prices rose 4.3 percent in the year between the first quarter of 2022 and 2023 Q1. While U.S. home prices are still rising, the increase from 2022 Q1 to 2023 Q1 were nowhere near the jump seen in the… [read more].

Framingham Based Ameresco Wins 2023 SEAL Award for Floating Solar Plant

June 3rd, 2023

FRAMINGHAM, MA — Ameresco, Inc., (NYSE: AMRC), a Framingham, MA based cleantech integrator specializing in energy efficiency and renewable energy, has been named a winner of the Environmental Initiatives Award by the SEAL Business Sustainability Awards for the second year in a row for establishing United States Southeast’s largest floating solar plant in a collaborative partnership with… [read more].

Peloton Recalls 2.2 Million Exercise Bikes Due to Fall and Injury Hazards

May 11th, 2023

FRAMINGHAM, MA — Those who own or use Peloton exercise bikes, (which can be found in many Framingham area gyms, hotels, clubs, spas, physical therapists, etc.), should be aware that Peloton has received 35 reports of the seat post breaking and detaching from the bike during use — including 13 reports of injuries including a fractured wrist,… [read more].

Ameresco Donates Portable Power Units to Help Support Communities Impacted by Natural Disasters

January 24th, 2023

FRAMINGHAM, MA — Ameresco, Inc., (NYSE: AMRC) announced they have donated three portable power stations to the Cajun Navy Ground Force. The Louisiana-based non-profit organization is focused on quickly responding during and after natural disasters to help socially vulnerable and marginalized populations in crisis. As hurricanes, storms and natural disasters have become a common threat to communities… [read more].

Framingham Man Convicted of Wire Fraud and Money Laundering

December 10th, 2022

![]()

FRAMINGHAM, MA — A federal jury in Boston convicted a Framingham man today for his role in a business email compromise (BEC) scheme. Gustaf Njei, 27, was convicted following a five-day jury trial of two counts of wire fraud, one count of structuring to avoid reporting requirements, one count of unlawful monetary transactions, and one count of… [read more].

MetroWest Chamber of Commerce President & CEO Stepping Down at End of Year

November 11th, 2022

![]()

FRAMINGHAM, MA — The MetroWest Chamber of Commerce recently announced that its current President and CEO, Jim Giammarinaro, will be stepping down at the end of the calendar year. “Earlier this year Jim informed the Board that, due to competing family and personal commitments, he would be resigning as President and CEO at the end of the… [read more].

TJX Recalls Baby Blankets Due to Choking, Entrapment and Strangulation Hazards

October 22nd, 2022

FRAMINGHAM, MA — The U.S. Consumer Product Safety Commission announced a recall of 108,000 Mittal International Baby Blankets sold in the U.S. (and in Canada) by Framingham, MA based TJX Company stores. The blankets are being recalled as the threads in the woven baby blankets can come loose and detach posing choking, entrapment and strangulation hazards…. [read more].

Perini Management Services, Inc. Awarded Three Federal Contracts Collectively Valued at $164 Million

October 21st, 2022

![[logo] tutor perini](https://www.framingham.com/news/wp-content/uploads/2022/10/tutor-perini-logo_175x115-150x99.jpg)

FRAMINGHAM, MA — Tutor Perini Corporation (NYSE: TPC) , a leading civil, building and specialty construction company (with roots in Framingham and Ashland MA going back for 1894), announced on October 19, 2022 that its subsidiary, Perini Management Services, Inc. (PMSI), has been awarded three fixed-price federal contracts collectively valued at approximately $164 million…. [read more].